The Data Engine and Technology Behind AI Insurance

Data Ingested to Date

Words

Over 2 billion words of litigation text – equivalent to the entire English Wikipedia ten times over.

Reading Time

It would take a human ~25 years to read it all (at 250 words/minute, 8 hours/day).

Our proprietary data processing pipeline continuously ingests and classifies litigation, filings and incidents daily, serving novel signals to our underwriters to enable them to make informed risk selection decisions.

We stay on top of fast moving loss trends globally

Realistic Disaster Scenarios are simulated against our policies and data

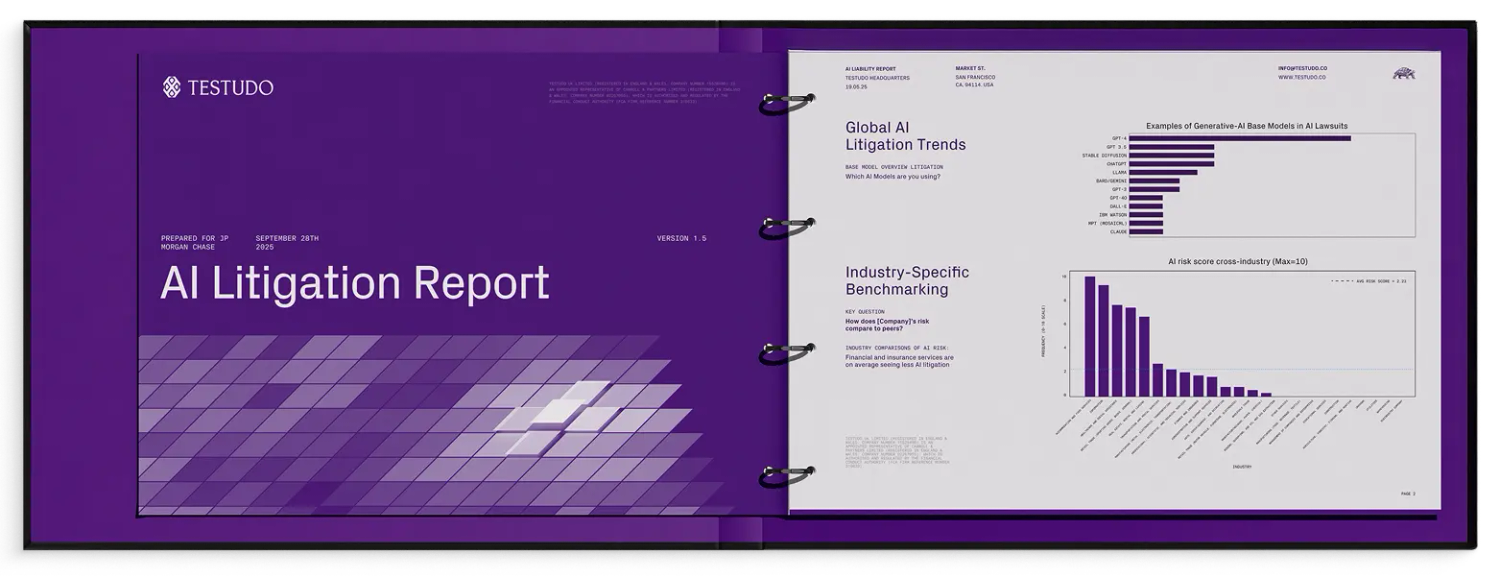

Our reports are data driven e.g. 2025 AI State of Play

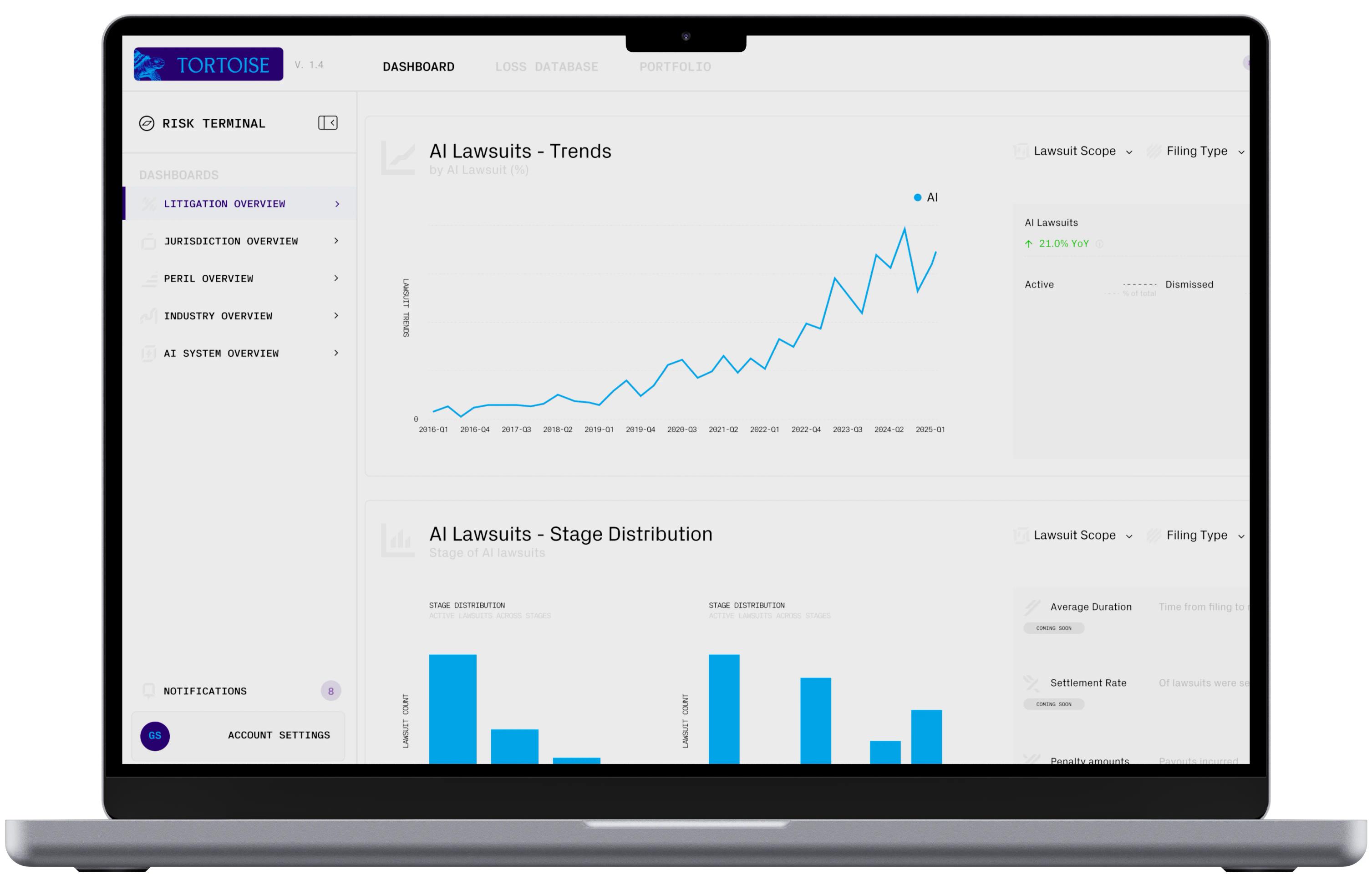

Built by an enterprise team trained in the world’s top institutions, Testudo’s Risk Engine is a full-stack platform to enable our underwriters to make best-in-class risk selection decisions. It centralizes insights, updates pricing, and transmits signals in real time.

By combining granular data, advanced AI, and portfolio controls, we price and manage AI risk with unmatched precision — all with lower operating costs through deep AI automation.

From Lawsuit to Risk Selection

Our unique view of risk is shaped by our proprietary AI Risk Engine — a system that requires no invasive technical integration with a company to asses their exposure.

Real-Time Risk Selection

Model Hallucinations Define Only 4.9% of GenAI Lawsuits

Our data shows a very small number of generative AI lawsuits in the USA involve claims related to AI "hallucinations"—instances where AI systems generate false or misleading information that causes harm. This highlights that the performance of an AI model has limited impact on a firm's AI liability exposure.

We deploy technology to maximise distribution velocity

We deliver a bespoke same day AI Risk Summary, quote and bind service.

Our AI Risk Summary provides an AI Risk Score and bespoke insights for enterprises based on our data.

We perform Active Liability Monitoring for our insureds to stay on top of fast moving loss trends.

Next Gen Underwriting Technology for Frontier Risk

Insurance underwriting has historically been a manual process often done based on human 'gut' feel. However once guidelines, policies and pricing have been defined by specialist humans, there is an opportunity for AI to assist in underwriting processes. This should help us make decisions better, faster, smarter, more efficient - ultimately enabling us to serve clients more effectively.