2026, The Year of AI Insurance.

Starting with the 2025 recap:

The AI insurance market ended 2025 in a slightly more advanced position than where it started, albeit much noisier. To quickly summarise the year in a few grossly oversimplified bullets:

- Media houses continue to give a platform to folks theorising about insuring and pricing the catastrophic AI harms caused by the base model provider.

- Insurers continue to worry about silent AI exposures and are starting to address them through internal working groups.

- Conditions have been tough for the few selling ‘affirmative’ AI insurance products that don’t address apparent coverage gaps caused by exclusions. Lengthy, complex distribution processes requiring technical audits & evaluations have exacerbated these tough conditions.

A quick reminder about the trifecta:

I have previously discussed something I call the trifecta, which helps form new insurance markets. I believe it is more true than it is false that new insurance categories tend to emerge from a trifecta. Here is a simplified description to remind you about the steps of trifecta:

- New regulations, technologies, and latent damages create fresh and previously unknown exposures (e.g., cyber),

- Those exposures drive unexpected or underestimated losses to insurers’ portfolios and balance sheets,

- This leads insurers to exclude and carve out these exposures from traditional policy forms because they can’t price them well or have suffered significant losses (or believe they will).

The trifecta sometimes leads to significant policy gaps, the need for new coverage, and, eventually, new dedicated risk transfer markets. These risk transfer market forces emerge so long as there are profitable risk pools, sufficient ways to manage accumulation risk, and scalable premium growth.

Early in the formation of these new transfer markets, there are opportunities for specialist MGAs, Coverholders, and nimble insurers with proprietary data, technology, and insurance expertise to price and underwrite these emerging risks.

Where do we find ourselves at the start of 2026?

So, how is the AI insurance market progressing using the trifecta as a very rough benchmark? I say 'rough' because I know the limitations of mental models and would lose my mind if our data scientists fell for confirmation or survivorship bias!

I talked last time about step 1 of the trifecta, but now it appears step 2 is well underway in certain pockets of risk.

Despite the academic fixation on catastrophic biological AI harms, for which the precautionary principle would suffice, the real-world risks in the early innings of the AI economy look entirely different.

The real-world exposure most companies face right now is liability risk. For example, companies are responsible for the harms caused by the outputs of a generative AI system they have deployed. Our data shows that generative AI lawsuits increased 137% in 2025 and continue to rise. We shared this data in our Generative AI Litigation Report.

However, for step 2 of the trifecta to be relevant, we need to see actual or anticipated significant insured losses. Well, this is happening now as well.

(Calm down, see my point above about confirmation bias 😉).

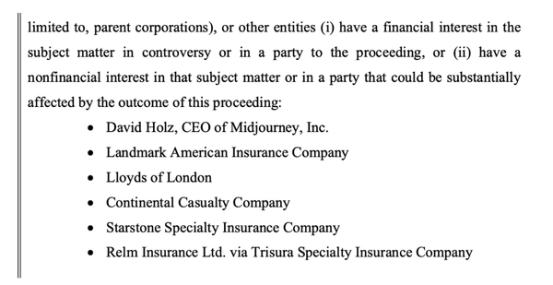

For example, in some lawsuits filed towards the end of last year, insurers are included in docket notices as parties with a financial interest in the lawsuit. Here is an example from Warner Bros' lawsuit against Midjourney, a generative AI technology company:

In addition, those insightful folks at Coalition have noted in their ‘State of Web Privacy’ report that chatbots were cited in 5% of all web privacy claims. So, without falling too hard for confirmation bias, whilst considering the increase in generative AI litigation and the examples above, it appears that actual losses are now working their way through to insurers' balance sheets. Whether they are ‘large’ is to be determined. Insurers will need to act and apply exclusions if and when dynamics and underwriting profitability change.

So that leaves step 3 of the trifecta: exclusions. There was a significant announcement regarding generative AI exclusions before the close of 2025.

Verisk announced that it filed commercial general liability exclusions in response to rapidly developing generative AI exposures, as insurers using their policy forms requested underwriting tools to address this emerging risk. This is a significant movement and leaves companies with uncovered exposures under a critical policy in their insurance programmes if they have deployed generative AI systems across their business. These clear exclusions create the most compelling and exciting indications to date that new products are required to address AI harms.

It may be the start of meaningful traction in the nascent AI insurance space.

Closing Thoughts:

With the launch of our Coverholder, working with our syndicate capacity partners at Lloyd’s, we are delighted to announce that we have created a generative AI third-party liability insurance policy to address some of the excluded exposures mentioned above.

We are a team of optimists at Testudo, and we believe there will be an AI economy that will require new risk infrastructure. We want to build that risk infrastructure and insure the AI economy so companies reap the rewards of this fantastic technology. We are also users of AI, applying it deeply into our business, and our exploring ai assisted underwriting, distribution strategies and broad based automation. More on that - another time!

It’s going to be an absolute privilege underwriting these AI exposures in the home of insurance innovation, Lloyd’s. We will keep you all up to date as we embark on our mission.

Next steps:

- The Testudo team is here to help you explore your AI insurance options. Get in touch to assess your AI exposure and learn how to manage your company’s risk.

- Check out our Research & Insights blog for more AI insurance news.